Top Green Hydrogen Companies Driving the Clean Energy Revolution in 2025

What is Green Hydrogen?

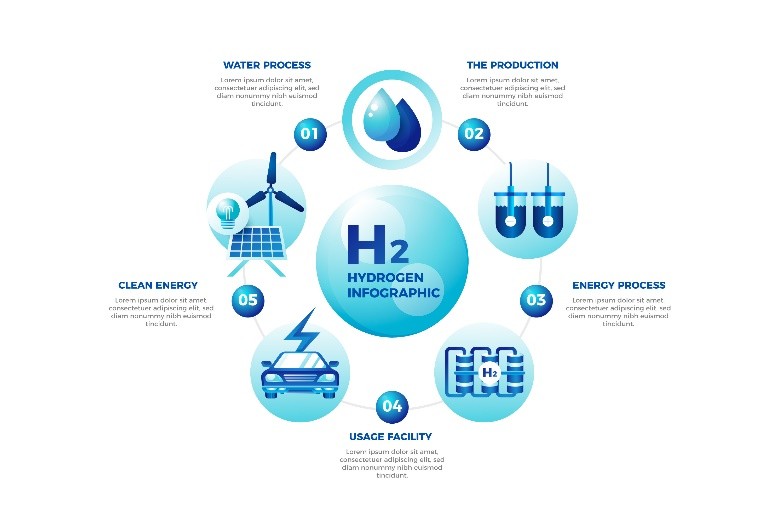

Green hydrogen is hydrogen produced using renewable energy sources—such as solar or wind power—to split water into hydrogen and oxygen through a process called electrolysis. Unlike fossil-fuel-based hydrogen, green hydrogen generates zero carbon emissions during production.

How Green Hydrogen Differs from Grey and Blue Hydrogen

Type | Production Source | Emissions |

Grey Hydrogen | Natural gas (steam methane reforming) | High CO₂ emissions |

Blue Hydrogen | Natural gas + carbon capture (CCS) | Lower, but not zero |

Green Hydrogen | Renewable energy + water (electrolysis) | Zero emissions |

- Grey hydrogen is the most common but also the most polluting.

- Blue hydrogen captures some emissions, but lifecycle emissions remain.

- Green hydrogen is fully sustainable and clean, powered entirely by renewable hydrogen sources.

Why Green Hydrogen Matters for Climate Goals

Green hydrogen plays a critical role in the global transition to net-zero emissions. Here’s why it’s vital:

- Decarbonizing hard-to-abate sectors: such as steel, cement, aviation, and shipping.

- Energy storage: Converts surplus renewable energy into hydrogen for later use.

- Supports the hydrogen economy: Builds a cleaner industrial and transport infrastructure.

- Geopolitical energy independence: Reduces reliance on fossil fuels and gas imports.

With global commitments to climate targets and COP agreements, green hydrogen is central to a clean energy future.

Why Green Hydrogen is Gaining Global Attention in 2025

In 2025, green hydrogen companies are at the center of the global clean energy transition. A combination of climate policy, major investments, and rapid technological innovation is driving the momentum behind green hydrogen production.

1. Climate Policies and Net-Zero Goals

Countries around the world are doubling down on their net-zero emissions targets by 2050—or sooner. Green hydrogen has emerged as a crucial tool to decarbonize sectors where electrification isn’t practical, such as:

- Heavy industry (steel, cement)

- Long-haul aviation and maritime transport

- High-temperature industrial heat

Governments are integrating green hydrogen into national energy strategies, pushing clean energy companies to scale up hydrogen infrastructure and supply chains.

2. Global Investments and Government Incentives

Massive funding and incentives are flowing into the green hydrogen economy:

- The U.S. Inflation Reduction Act includes tax credits up to $3/kg for green hydrogen production.

- India’s National Hydrogen Mission is investing over $2 billion in green hydrogen companies.

- Australia, Germany, and Japan are forming strategic partnerships to import/export green hydrogen.

This surge in global interest has led to the rise of numerous green hydrogen companies, both startups and energy giants, actively developing projects worldwide.

3. Cost Trends and Technological Advancements

In 2025, the cost of green hydrogen production is falling due to:

- Cheaper renewable energy (especially solar and wind)

- More efficient electrolyzers with longer lifespans

- Economies of scale from gigawatt-scale hydrogen hubs

As hydrogen fuel becomes more affordable and competitive with fossil-based alternatives, clean energy companies are accelerating deployments at commercial scale.

The Role of Green Hydrogen Companies

Leading green hydrogen companies like Plug Power, Nel ASA, and Fortescue Future Industries are:

- Launching large-scale electrolyzer plants

- Partnering with governments and industries

- Expanding into new global markets

These companies are building the backbone of the emerging hydrogen economy, positioning themselves as key players in the decarbonized energy landscape.

Challenges Facing Green Hydrogen Companies

Despite growing momentum in 2025, green hydrogen companies face several complex challenges that limit their scalability and profitability. These issues span cost, infrastructure, policy, and technology—posing hurdles that the industry must overcome to reach mainstream adoption.

1. High Cost of Electrolysis

One of the primary barriers to widespread green hydrogen production is the high cost of electrolysis, the process of splitting water into hydrogen and oxygen using electricity.

- Electrolyzers are still expensive and energy-intensive.

- Capital expenditure for hydrogen plants remains high.

- Many projects are economically viable only with subsidies or tax incentives.

2. Dependence on Renewable Energy

Green hydrogen companies rely entirely on renewable energy sources like solar, wind, or hydropower. This creates several bottlenecks:

- Intermittency and variability in renewable power supply.

- Need for massive land and grid infrastructure to scale hydrogen production.

- Competition with other sectors for clean electricity.

Without a consistent and affordable renewable energy supply, green hydrogen projects face limited scalability and uncertain ROI.

3. Transportation and Storage Challenges

Hydrogen is a light, volatile gas that requires specialized infrastructure for safe transport and storage:

- Requires high-pressure tanks or liquefaction at cryogenic temperatures.

- Existing pipeline networks are largely incompatible.

- Transportation adds substantial cost, especially for long distances.

These logistical issues make hydrogen fuel distribution difficult, particularly in remote or developing regions.

Policy and Regulatory Uncertainty in Emerging Markets

Inconsistent policies and a lack of global standards create risk for clean energy companies and investors:

- No unified carbon pricing or hydrogen certification systems.

- Emerging economies often lack the regulatory frameworks to support large-scale hydrogen infrastructure.

- Permitting delays, land acquisition, and local opposition can stall projects.

While regions like the EU and U.S. are making progress, many parts of Africa, Asia, and Latin America still pose policy-related hurdles for green hydrogen companies.

Future Outlook: What’s Next for the Green Hydrogen Industry?

As the global push for decarbonization intensifies, green hydrogen companies are entering a new phase of growth. Between 2025 and 2030, the green hydrogen industry is expected to evolve from pilot projects to full-scale commercialization across key sectors and regions.

1. Key Trends for 2025–2030

- Scale and commercialization: Gigawatt-scale hydrogen hubs and export terminals will become more common, particularly in Europe, the Middle East, and Australia.

- Hydrogen price parity: Technological advancements and policy incentives will drive green hydrogen costs closer to grey hydrogen, especially in sun-rich regions.

- Hydrogen as a global commodity: A future global market for hydrogen trading will emerge, with standardized contracts and certification systems.

- Hydrogen blending and infrastructure upgrades: More natural gas pipelines will be upgraded to handle hydrogen blends, increasing distribution capabilities.

These trends position green hydrogen companies as central players in the future clean energy economy.

2. Growth of Emerging Markets

Emerging markets are becoming key players in green hydrogen production and export:

- India is targeting 5 MTPA (million tonnes per annum) of green hydrogen capacity by 2030.

- Chile, Namibia, and Morocco offer ideal renewable conditions and proximity to European markets.

- Gulf nations like Saudi Arabia and the UAE are diversifying from oil by investing heavily in hydrogen mega-projects.

These countries are attracting international partnerships and financing from clean energy companies, multilateral banks, and sovereign funds.

3. Sectoral Adoption: Aviation, Steel, and Shipping

Green hydrogen’s versatility makes it essential for decarbonizing “hard-to-electrify” sectors:

Aviation:

- Used in synthetic aviation fuels (e-fuels)

- Companies like Airbus and ZeroAvia are testing hydrogen-powered aircraft

Steel:

- Hydrogen is replacing coal in Direct Reduced Iron (DRI) processes

- Major steelmakers like ArcelorMittal and SSAB are partnering with green hydrogen firms

Shipping:

- Green ammonia (derived from hydrogen) will power next-gen cargo ships

- Ports in Rotterdam, Singapore, and Los Angeles are building hydrogen-ready infrastructure

These applications will drive demand for green hydrogen production, pushing hydrogen fuel into mainstream commercial use.

Frequently Asked Questions

1.What is the largest green hydrogen company?

As of 2025, Yonderh2, Air Liquide and Plug Power are among the largest green hydrogen companies based on project scale, global footprint, and investment.

2.How do green hydrogen companies produce hydrogen?

Green hydrogen companies produce hydrogen using electrolysis, a process that splits water (H₂O) into hydrogen and oxygen using electricity from renewable sources like wind, solar, or hydro. This method generates zero carbon emissions, unlike traditional fossil-fuel-based hydrogen.

3.What sectors are using green hydrogen?

Green hydrogen is being adopted in several hard-to-decarbonize sectors, including:

- Steel manufacturing

- Aviation and shipping

- Chemical production (e.g., ammonia, methanol)

- Heavy-duty transportation

- Energy storage and backup power

These industries are leveraging hydrogen to reduce reliance on fossil fuels and cut greenhouse gas emissions.

Conclusion: The Future is Powered by Green Hydrogen

The rise of green hydrogen companies marks a pivotal shift in the global energy landscape. From climate-conscious startups to legacy energy giants, these innovators are building the foundation of a clean, zero-emission economy.

Need Help Choosing the Right Hydrogen Partner? Book a 15-Min Strategy Call